Multiple Choice

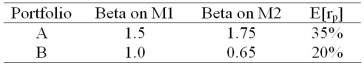

There are two independent economic factors M1 and M2.The risk-free rate is 5% and all stocks have independent firm-specific components with a standard deviation of 25%.Portfolios A and B are well diversified.Given the data below which equation provides the correct pricing model?

A) E(rP) = 5 + 1.12 P1 + 11.86 P2

B) E(rP) = 5 + 4.96 P1 + 13.26 P2

C) E(rP) = 5 + 3.23 P1 + 8.46 P2

D) E(rP) = 5 + 8.71 P1 + 9.68 P2

Correct Answer:

Verified

Correct Answer:

Verified

Q51: In a single-factor market model the beta

Q74: Consider the CAPM. The expected return on

Q75: Two investment advisors are comparing performance.Advisor A

Q77: The risk premium for exposure to aluminum

Q78: What is the beta for a portfolio

Q79: The measure of risk used in the

Q80: The risk-free rate and the expected market

Q80: In a study conducted by Jagannathan and

Q83: Security A has an expected rate of

Q84: Consider the one-factor APT.The standard deviation of