Multiple Choice

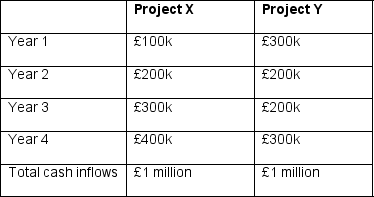

Jigger Ltd is considering two alternative projects; each of which will involve an initial outlay of £600,000. Both will have a four-year life and are expected to yield the following cash inflows: Which of the following is not true?

Which of the following is not true?

A) Project X has a payback period of 3 years.

B) Project Y has a payback period of 2.5 years.

C) Project X will always yield a higher NPV than project Y.

D) Project Y will always yield a higher NPV than project X.

Correct Answer:

Verified

Correct Answer:

Verified

Q1: A business can either receive £200 now

Q2: If a 10% discount rate is used,

Q3: Jigger Ltd is considering undertaking project X,

Q5: The cash flows associated with a project

Q6: Shep Ltd is considering a possible four-year

Q7: What does the accounting rate of return

Q8: Alternative projects, M and N, have been

Q9: Which of the following statements concerning the

Q10: Which of the following is an advantage