Multiple Choice

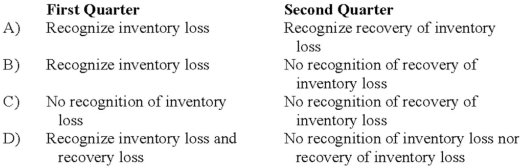

Tyler Company incurred an inventory loss due to a decline in market prices during its first quarter of operations in 20X8. At the end of the first quarter, management of the company believed the decline in market prices to be permanent. In the second quarter, the market prices of Tyler's inventories increased above their acquisition cost. Market prices remained higher than acquisition cost during the remainder of 20X8. How should Tyler report the facts above on its first and second quarter income statements?

A) Option A

B) Option B

C) Option C

D) Option D

Correct Answer:

Verified

Correct Answer:

Verified

Q7: How would a company report a change

Q13: All of the following are differences between

Q20: ASC 280,Disclosure about Segments of an Enterprise

Q26: Wakefield Company uses a perpetual inventory system.

Q28: Note: This is a Kaplan CPA Review

Q32: Mason Company paid its annual property taxes

Q33: Note: This is a Kaplan CPA Review

Q34: Note: This is a Kaplan CPA Review

Q35: Trimester Corporation's revenue for the year ended

Q36: Lloyd Corporation reports the following information for