Essay

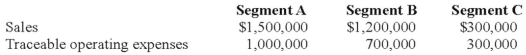

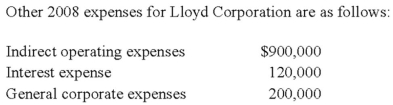

Lloyd Corporation reports the following information for 20X8 for its three operating segments:

Indirect operating expenses are allocated to segments based upon the ratio of each segment's traceable operating expenses to total traceable operating expenses. Interest expense is allocated to segments based upon the ratio of each segment's sales to total sales.

Required:

a) Calculate the operating profit or loss for each of the segments for 20X8.

b) Determine which segments are reportable, applying the operating profit or loss test.

Correct Answer:

Verified

a) Operating profit or loss for each seg...View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Correct Answer:

Verified

View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Q5: Which of the following are established by

Q25: During the third quarter of 20X8,Pride Company

Q31: Tyler Company incurred an inventory loss due

Q32: Mason Company paid its annual property taxes

Q33: Note: This is a Kaplan CPA Review

Q34: Note: This is a Kaplan CPA Review

Q35: Trimester Corporation's revenue for the year ended

Q37: Note: This is a Kaplan CPA Review

Q38: Iona Corporation is in the process of

Q52: Derby Company pays its executives a bonus