Multiple Choice

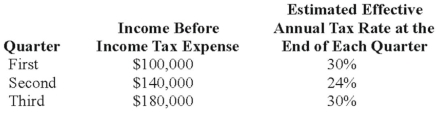

Denver Company, a calendar-year corporation, had the following actual income before income tax expense and estimated effective annual income tax rates for the first three quarters in 20X8:  Denver's income tax expense in its interim income statement for the third quarter should be:

Denver's income tax expense in its interim income statement for the third quarter should be:

A) $126,000.

B) $68,400.

C) $62,400.

D) $54,000.

Correct Answer:

Verified

Correct Answer:

Verified

Q1: In 20X6 and 20X7,each of Putney Company's

Q4: Main Manufacturing Corporation reported consolidated revenues of

Q5: Note: This is a Kaplan CPA Review

Q8: Stone Company reported $100,000,000 of revenues on

Q9: Toledo Imports, a calendar-year corporation, had the

Q10: Trevor Company discloses supplementary operating segment information

Q34: Interim income statements are required for Smith

Q38: Five of eight internally reported operating segments

Q44: On June 30,20X8,String Corporation incurred a $220,000

Q47: The income tax expense applicable to the