Multiple Choice

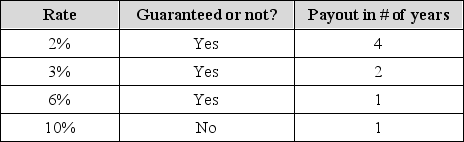

An investor is faced with a decision of investing $5,000. The investor is in no hurry to cash in on their gains and is considered risk-averse. Which option should they choose?

A) The 2% rate, because it is the longest payout

B) The 3% rate

C) The 6% rate, because it is the highest guaranteed return

D) The 10% rate, because the risk is worth the higher return

E) Either the 2% rate or the 6% rate, as they both offer the same total return

Correct Answer:

Verified

Correct Answer:

Verified

Q18: When decision-making is influenced by a recent

Q19: Some environmental scientists have interviewed residents in

Q20: When a situation is presented in such

Q21: A community is faced with making a

Q22: Categorize the following people in relation to

Q24: Choose the correct interpretation of the charts

Q25: Current energy resources from fossil fuels have

Q26: Suppose you are in charge of holding

Q27: Describe perceived risk and give an example.

Q28: Which of the following statements about excessive