Essay

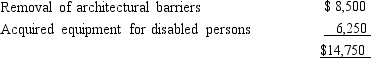

Golden Corporation is an eligible small business for purposes of the disabled access credit.During the year, Golden makes the following expenditures on a structure originally placed in service in 1988.

In addition, $8,000 was expended by Golden on a building originally placed in service in the current year to ensure easy accessibility by disabled individuals.Calculate the amount of the disabled access credit available to Golden Corporation.

In addition, $8,000 was expended by Golden on a building originally placed in service in the current year to ensure easy accessibility by disabled individuals.Calculate the amount of the disabled access credit available to Golden Corporation.

Correct Answer:

Verified

The expenditures of $8,000 incurred on...

The expenditures of $8,000 incurred on...View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Correct Answer:

Verified

View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Q16: Why is there no AMT adjustment for

Q18: In 2018, the amount of the deduction

Q27: Cher sold undeveloped land that originally cost

Q32: The purpose of the work opportunity tax

Q35: If Abby's alternative minimum taxable income exceeds

Q38: How can an AMT adjustment be avoided

Q42: Brenda correctly has calculated her regular tax

Q59: In deciding whether to enact the alternative

Q65: Ted, who is single, owns a personal

Q70: Unless circulation expenditures are amortized over a