Multiple Choice

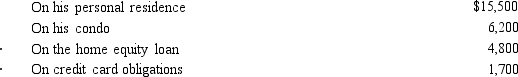

Ted, who is single, owns a personal residence in the city.He also owns a condo near the ocean.He uses the condo as a vacation home.In March, he borrowed $50,000 on a home equity loan and used the proceeds to acquire a luxury automobile.During the year, he paid the following amounts of interest.  What amount, if any, must Ted recognize as an AMT adjustment in 2018?

What amount, if any, must Ted recognize as an AMT adjustment in 2018?

A) $0

B) $4,800

C) $6,200

D) $11,000

Correct Answer:

Verified

Correct Answer:

Verified

Q16: Why is there no AMT adjustment for

Q27: Cher sold undeveloped land that originally cost

Q32: The purpose of the work opportunity tax

Q38: How can an AMT adjustment be avoided

Q42: Brenda correctly has calculated her regular tax

Q56: Any unused general business credit must be

Q59: In deciding whether to enact the alternative

Q67: Golden Corporation is an eligible small business

Q70: Unless circulation expenditures are amortized over a

Q84: Income from some long-term contracts can be