Essay

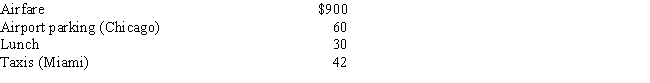

Alfredo, a self-employed patent attorney, flew from his home in Chicago to Miami, had lunch alone at the airport, conducted business in the afternoon, and returned to Chicago in the evening. His expenses were as follows:

What is Alfredo's deductible expense for the trip?

What is Alfredo's deductible expense for the trip?

Correct Answer:

Verified

$1,002 ($900 + $60 +...View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Correct Answer:

Verified

View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Q2: A taxpayer who uses the automatic mileage

Q16: In terms of income tax treatment, what

Q26: Under the actual cost method, which, if

Q49: Sue performs services for Lynn. Regarding this

Q81: An education expense deduction may be allowed

Q83: Travel status requires that the taxpayer be

Q107: Sue performs services for Lynn. Regarding this

Q123: A deduction for parking and other traffic

Q137: Brian makes gifts as follows:<br><br> <img src="https://d2lvgg3v3hfg70.cloudfront.net/TB1280/.jpg"

Q140: Robert entertains several of his key clients