Essay

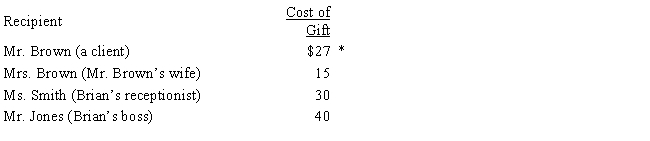

Brian makes gifts as follows:

* Includes $2 for gift wrapping

* Includes $2 for gift wrapping

Presuming adequate substantiation and no reimbursement, how much may Brian deduct?

Correct Answer:

Verified

$52 ($27 + $25). The deduction for Mr. B...View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Correct Answer:

Verified

$52 ($27 + $25). The deduction for Mr. B...

View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Related Questions

Q2: A taxpayer who uses the automatic mileage

Q16: In terms of income tax treatment, what

Q26: Under the actual cost method, which, if

Q81: An education expense deduction may be allowed

Q83: Travel status requires that the taxpayer be

Q86: If a business retains someone to provide

Q123: A deduction for parking and other traffic

Q135: Alfredo, a self-employed patent attorney, flew from

Q140: Robert entertains several of his key clients

Q141: Match the statements that relate to each