Essay

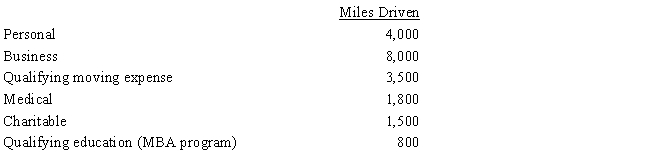

Rod uses his automobile for both business and personal use and claims the automatic mileage rate for all purposes. During 2017, his mileage was as follows:

How much can Rod claim for mileage?

How much can Rod claim for mileage?

Correct Answer:

Verified

$5,819 [(8,800 miles × $0.535,...View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Correct Answer:

Verified

View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Q1: Meredith holds two jobs and attends graduate

Q2: Tracy, the regional sales director for a

Q5: Aaron is a self-employed practical nurse who

Q6: A worker may prefer to be treated

Q7: Match the statements that relate to each

Q8: Match the statements that relate to each

Q9: Match the statements that relate to each

Q11: Employees who render an adequate accounting to

Q65: When contributions are made to a traditional

Q73: Jake performs services for Maude.If Maude provides