Essay

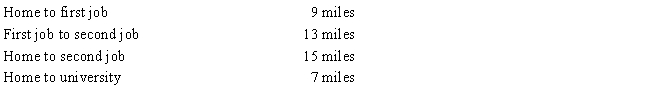

Meredith holds two jobs and attends graduate school on weekends. The education improves her skills, but does not qualify her for a new trade of business. Before going to the second job, she returns home for dinner. Relevant mileage is as follows:

How much of the mileage qualifies for deduction purposes?

How much of the mileage qualifies for deduction purposes?

Correct Answer:

Verified

Correct Answer:

Verified

Q2: Tracy, the regional sales director for a

Q4: Rod uses his automobile for both business

Q5: Aaron is a self-employed practical nurse who

Q6: A worker may prefer to be treated

Q7: Match the statements that relate to each

Q8: Match the statements that relate to each

Q9: Match the statements that relate to each

Q11: Employees who render an adequate accounting to

Q65: When contributions are made to a traditional

Q73: Jake performs services for Maude.If Maude provides