Multiple Choice

Use the information below to answer the following questions.

On December 31, 2017, Reagan Inc. signed a lease with Silver Leasing Co. for some equipment having a seven-year useful life. The lease payments are made by Reagan annually, beginning at signing date. Title does not transfer to the lessee, so the equipment will be returned to the lessor on December 31, 2023. There is no purchase option, and Reagan guarantees a residual value to the lessor on termination of the lease.

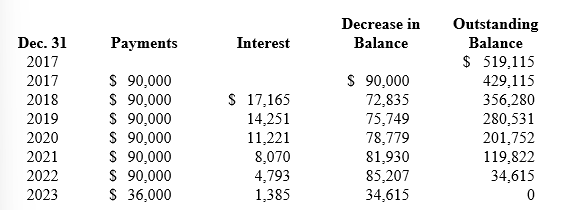

Reagan's lease amortization schedule appears below:

-What is the balance of the lease liability on Reagan's December 31, 2019, balance sheet (after the third lease payment is made) ?

A) $280,531.

B) $190,530.

C) $266,280.

D) $356,280.

Correct Answer:

Verified

Correct Answer:

Verified

Q92: In accounting for operating leases, the lessee

Q93: From the perspective of the lessee, leases

Q94: Karla Salons leased equipment from Smith Co.

Q95: On January 1, 2018, Calloway Company leased

Q96: Discuss the financial statement disclosure requirements for

Q98: If the lessor records deferred rent revenue

Q99: Technoid Inc. sells computer systems. Technoid leases

Q100: Here is a lease amortization schedule for

Q101: If the lessee is expected to take

Q102: On January 1, 2018, Rastall Co. signed