Multiple Choice

On January 1, 2018, Calloway Company leased a machine to Zone Corporation. The lease qualifies as a sales-type lease. Calloway paid $240,000 for the machine and is leasing it to Zone for $34,000 per year, an amount that will return 10% to Calloway. The present value of the lease payments is $240,000. The lease payments are due each January 1, beginning in 2018. What is the appropriate interest entry on December 31, 2018?

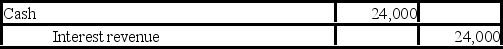

A)

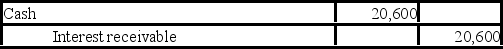

B)

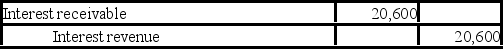

C)

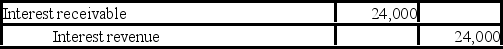

D)

Correct Answer:

Verified

Correct Answer:

Verified

Q90: Python Company leased equipment from Hope

Q91: On September 1, 2018, Custom Shirts Inc.

Q92: In accounting for operating leases, the lessee

Q93: From the perspective of the lessee, leases

Q94: Karla Salons leased equipment from Smith Co.

Q96: Discuss the financial statement disclosure requirements for

Q97: Use the information below to answer the

Q98: If the lessor records deferred rent revenue

Q99: Technoid Inc. sells computer systems. Technoid leases

Q100: Here is a lease amortization schedule for