Multiple Choice

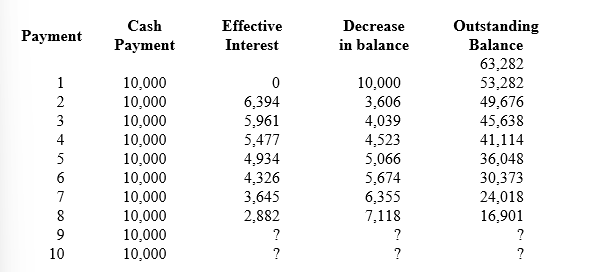

Refer to the following lease amortization schedule. The 10 payments are made annually starting with the beginning of the lease. Title does not transfer to the lessee and there is no purchase option or guaranteed residual value. The asset has an expected economic life of 12 years. The lease is noncancelable.

-Like other assets, the cost of a leasehold improvement is allocated as depreciation expense over its useful life to the lessee, which will be:

A) The shorter of the physical life of the asset or the lease term.

B) The physical life of the asset.

C) The lease term.

D) A time period determined by management.

Correct Answer:

Verified

Correct Answer:

Verified

Q131: I. Lasch Co. recorded a right-of-use asset

Q132: On December 31, 2018, B Corp. sold

Q133: On January 1, 2018, Robertson Construction leased

Q134: Refer to the following lease amortization schedule.

Q135: The costs that (a) are associated directly

Q137: On January 1, 2018, Patagonia Leasing leased

Q138: Big Bucks leased equipment to Shannon Company

Q139: By the lessee, a lessee-guaranteed residual value

Q140: Which of the following statements regarding a

Q141: Refer to the following lease amortization schedule.