Multiple Choice

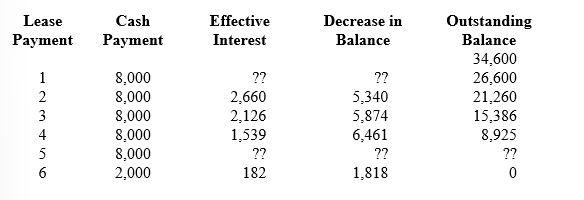

Refer to the following lease amortization schedule. The five payments are made annually starting with the beginning of the lease. A $2,000 purchase option is reasonably certain to be exercised at the end of the five-year lease. The asset has an expected economic life of eight years.

-What would be the amount of interest expense recorded with payment 5?

A) $2,000.

B) $893.

C) $7,107.

D) $1,107.

Correct Answer:

Verified

Correct Answer:

Verified

Q129: Karla Salons leased equipment from Smith Co.

Q130: 1) In a lease transaction, what are

Q131: I. Lasch Co. recorded a right-of-use asset

Q132: On December 31, 2018, B Corp. sold

Q133: On January 1, 2018, Robertson Construction leased

Q135: The costs that (a) are associated directly

Q136: Refer to the following lease amortization schedule.

Q137: On January 1, 2018, Patagonia Leasing leased

Q138: Big Bucks leased equipment to Shannon Company

Q139: By the lessee, a lessee-guaranteed residual value