Essay

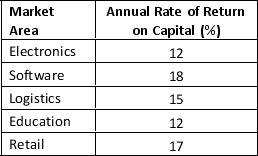

Northwest California Ventures Ltd. has decided to provide capital in five market areas for the start-ups. The investment consultant for the venture capital company has projected an annual rate of return based on the market risk, the product, and the size of the market.

The maximum capital provided will be $5 million.

The consultant has imposed conditions on allotment of capital based on the risk involved in the market.

• The capital provided to retail should be at most 40 percent of the total capital.

• The capital for education should be 26 percent of the total of other four markets (Electronics, Software, Logistics, and Retail)

• Logistics should be at least 15 percent of the total capital.

• The capital allocated for Software plus Logistics should be no more than the capital allotted for Electronics.

• The capital allocated for Logistics plus Education should not be greater than that allocated to Retail.

Calculate the expected annual rate of return based on the allocation of capital to each market area to maximize the return on capital provided. Also, show the allocation of capital for each market area.

Correct Answer:

Verified

Let x₁ = investment on Electronics

x₂ = ...View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Correct Answer:

Verified

x₂ = ...

View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Q4: Problems with infeasible solutions arise in practice

Q9: Geometrically, binding constraints intersect to form the<br>A)subspace.<br>B)optimal

Q12: The assumption that is necessary for a

Q14: A mathematical function in which each variable

Q16: The supervisor of a production company is

Q17: A _ refers to a constraint that

Q20: Reference - 8.1: Use the information given

Q22: A manager of a quality testing team

Q23: The nonnegativity constraints create a feasible region

Q35: Michael has decided to invest $40,000 in