Essay

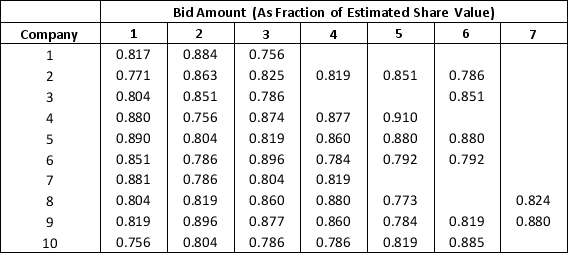

A specialty hedge fund is considering the purchase of a Jackson Pollock painting. It estimates the value of the painting to be $185 million. In an auction, both the number of competing bids and the amount of the competing bids is uncertain. The hedge fund has maintained a file summarizing 10 recent art auctions that it believes are similar to the upcoming auction. It is considering a bid of $163 million and would like to evaluate its chances of winning the upcoming auction with this bid.

a. Construct a spreadsheet simulation model for this auction. Use a discrete uniform distribution between the minimum and maximum number of bidders in the 10 observed auctions to model the number of bidders in the Jackson Pollock auction. Fit a realistic distribution to the bid data to generate values of competing bid amounts. Use ASP to apply simulation optimization to determine the hedge fund's bid amount that maximizes the expected return = P(winning auction)*(185 - bid amount). Hint: Placing reasonable bounds on the highest and lowest possible bid amount will greatly assist the optimization algorithm.

a. Construct a spreadsheet simulation model for this auction. Use a discrete uniform distribution between the minimum and maximum number of bidders in the 10 observed auctions to model the number of bidders in the Jackson Pollock auction. Fit a realistic distribution to the bid data to generate values of competing bid amounts. Use ASP to apply simulation optimization to determine the hedge fund's bid amount that maximizes the expected return = P(winning auction)*(185 - bid amount). Hint: Placing reasonable bounds on the highest and lowest possible bid amount will greatly assist the optimization algorithm.

b. What is the probability that the hedge fund wins the auction if it bids the amount that maximizes its expected return?

Correct Answer:

Verified

Correct Answer:

Verified

Q7: A tourist bus can accommodate 80 people

Q10: The Excel function _ generates integer values

Q11: The quality of a device should be

Q15: The weekly demand for an item in

Q18: A _ analysis involves considering alternative values

Q25: The choice of the probability distribution for

Q32: The _ function is used to generate

Q38: The outcome of a simulation experiment is

Q40: In a simulation process, the error of

Q49: The Excel add-in _ is used to