Essay

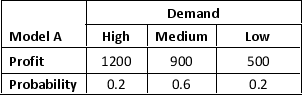

Visual Park is considering marketing one of its two television models for coming Christmas season: Model A or Model B. Model A is a unique featured television and appears to have no competition. Estimated profits (in thousand dollars) under high, medium, and low demand are given below:

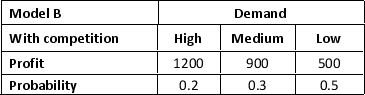

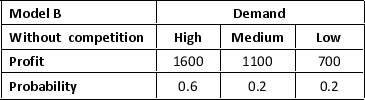

Visual Park is optimistic about the TV Model B. However, the concern is that profitability will be affected if a competitor launches a TV model which has similar features as Model B. Estimated profits (in thousand dollars) with and without competition is as follows:

a. Develop a decision tree for the Visual Park problem.

a. Develop a decision tree for the Visual Park problem.

b. For planning purposes, Visual Park believes there is a 0.7 probability that its competitor will launch a TV model similar to Model B. Given this probability of competition, the director of planning recommends marketing the Model A. Using expected value, what is your recommended decision?

c. Show a risk profile for your recommended decision.

d. Use sensitivity analysis to determine the probability of competition for Model B would have to be for you to change your recommended decision alternative.

Correct Answer:

Verified

a.

b. EV(node 2) = 0.2(1200) + 0.6(90...View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Correct Answer:

Verified

b. EV(node 2) = 0.2(1200) + 0.6(90...

View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Q3: The minimax regret approach is<br>A)purely optimistic.<br>B)purely conservative.<br>C)both

Q6: The utility function for money is a

Q11: _ is a measure of the total

Q17: The weighted average of the payoffs for

Q25: For a maximization problem, the conservative approach

Q38: A measure of the outcome of a

Q50: Meega airlines decided to offer direct service

Q51: Emil Hansen is interested in leasing a

Q53: Reference - 12.1: Use the payoff table

Q60: A construction company must decide on the