Multiple Choice

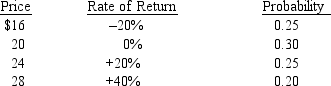

Phoenix Company common stock is currently selling for $20 per share.Security analysts at Smith Blarney have assigned the following probability distribution to the price of (and rate of return on) Phoenix stock one year from now:

Assuming that Phoenix is not expected to pay any dividends during the coming year, determine the expected rate of return on Phoenix Stock.

A) 8%

B) 0%

C) 10%

D) 40%

Correct Answer:

Verified

Correct Answer:

Verified

Q6: Dana has a portfolio of 8 securities,

Q14: Assume that the rate of return on

Q57: Compute the risk premium for the stock

Q58: In general, when the correlation coefficient between

Q62: Phoenix Company common stock is currently selling

Q63: The is a relative measure of variability

Q64: Investors can obtain high returns in their

Q65: The yield to maturity on ACL bonds

Q74: The term structure of interest rates is

Q96: List the various risk elements that are