Multiple Choice

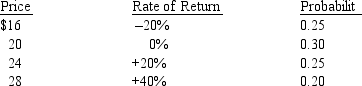

Phoenix Company common stock is currently selling for $20 per share.Security analysts at Smith Blarney have assigned the following probability distribution to the price of (and rate of return on) Phoenix stock one year from now:

Assuming that Phoenix is not expected to pay any dividends during the coming year, determine the standard deviation of possible rates of return on Phoenix stock (to the nearest tenth of a percent) .

A) 456%

B) 20.9%

C) 2.2%

D) 21.4%

Correct Answer:

Verified

Correct Answer:

Verified

Q12: List types of events that influence systematic

Q14: Assume that the rate of return on

Q57: Compute the risk premium for the stock

Q58: In general, when the correlation coefficient between

Q60: Phoenix Company common stock is currently selling

Q63: The is a relative measure of variability

Q64: Investors can obtain high returns in their

Q65: The yield to maturity on ACL bonds

Q67: Elephant Company common stock has a beta

Q96: List the various risk elements that are