Multiple Choice

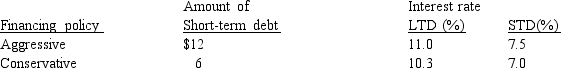

Laserscope Inc.is trying to determine the best combination of short-term and long-term debt to employ in financing its assets.Laserscope will have $16 million in current assets and $20 million in fixed assets next year and expects operating income (EBIT) to be $4.1 million.The company's tax rate is 40% and its debt ratio is 50%.The firm's debt will be financed by one of the following policies:

What is the return on shareholder's equity under each policy?

A) aggressive = 12.70% & conservative = 12.22%

B) aggressive = 8.47% & conservative = 8.14%

C) aggressive = 4.23% & conservative = 4.07%

D) aggressive = 7.67% & conservative = 8.81%

Correct Answer:

Verified

Correct Answer:

Verified

Q3: Which of the following factors does not

Q35: All other things being equal, a policy

Q43: Renfro Industries balance sheet for December 31,

Q44: Cisco Systems wishes to analyze the joint

Q45: What is the length of the cash

Q46: If a firm shows a profit on

Q48: Laserscope has an inventory conversion period of

Q49: The length of the operating cycle for

Q50: Of the accounts listed, the account(s) that

Q52: If Swatch's inventory conversion period is 45