Multiple Choice

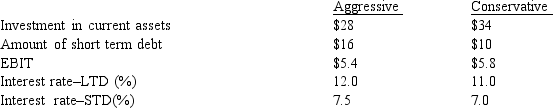

Cisco Systems wishes to analyze the joint impact of its working capital investment and financing policies on shareholder return.The company has $24 million in fixed assets.Cisco wishes to maintain a debt ratio of 40%.The company's tax rate is also 40%.The following information was developed for the two policies under consideration (dollars in millions) :

For the aggressive approach, Cisco's ROE is and for the conservative approach the ROE is .

A) 4.18%, 3.77%

B) 11.62%, 10.48%

C) 6.97%, 6.29%

D) none of these are correct

Correct Answer:

Verified

Correct Answer:

Verified

Q3: Which of the following factors does not

Q39: Crystal Oil has $9 million in accounts

Q40: An anticipated need for short-term borrowed funds

Q41: The rate of return on fixed assets

Q43: Renfro Industries balance sheet for December 31,

Q45: What is the length of the cash

Q46: If a firm shows a profit on

Q47: Laserscope Inc.is trying to determine the best

Q48: Laserscope has an inventory conversion period of

Q49: The length of the operating cycle for