Multiple Choice

Assume that the economy starts at a 0% output gap. Now suppose that banks begin to fear the risk of default and the risk premium rises by 2%. Which of the following figures shows what happens in this scenario?

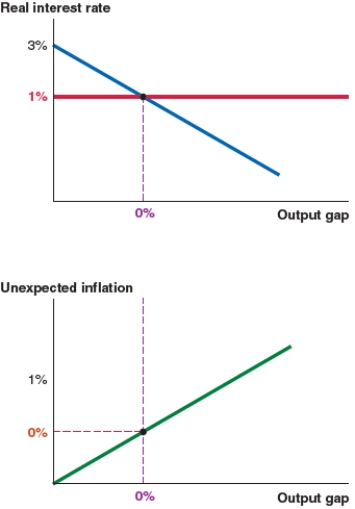

Figure A

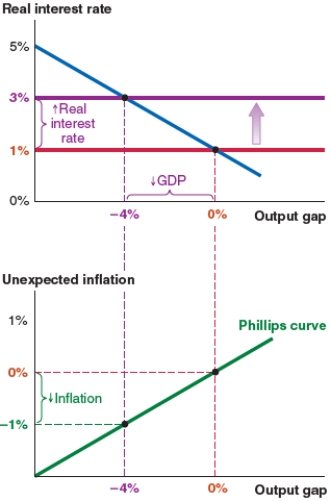

Figure B

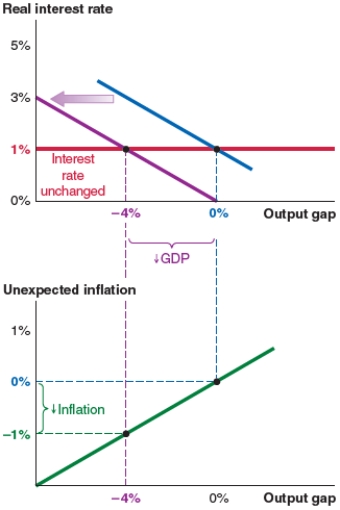

Figure C

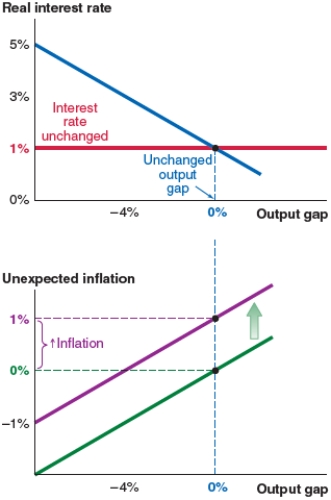

Figure D

A) Figure A (no change)

B) Figure B (an upward shift of the MP curve and a new interest rate of 3%)

C) Figure C (a leftward shift of the IS curve and an output gap of -4%)

D) Figure D (an upward shift of the Phillips curve and 1% unexpected inflation)

Correct Answer:

Verified

Correct Answer:

Verified

Q30: If the real interest rate rises in

Q31: In the IS-MP analysis in the Fed

Q32: In the IS-MP analysis in the Fed

Q33: In 2017, nearly 3.5% of Vietnamese imports

Q34: In the IS-MP analysis in the Fed

Q36: If a spending shock increases aggregate expenditure

Q37: The Fed model links the IS, MP,

Q38: Suppose the government increases taxes on corporations.

Q39: Which of the following graphs correctly represents

Q40: Take a look at the IS-MP-PC model