Multiple Choice

Parnell Industries

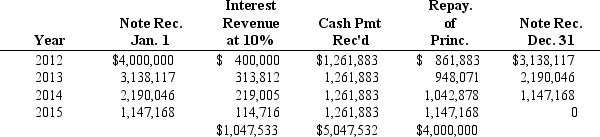

Parnell Industries sold a copy machine to Ranger Inc. on January 1, 2012. The sale price of the machine was $4,000,000 and the machine cost $3,200,000 for Parnell to manufacture. Ranger will make four payments at the end of each year, beginning with 2012, of $1,261,883 each. The four payments of $1,261,883 when discounted at 10% have a present value of $4,000,000. An amortization table appears below:

-If Parnell Industries is uncertain that it will collect all four payments from Ranger Inc.and uses the installment method of accounting for revenue recognition what amount of gross profit should Parnell recognize in 2012 from the sale?

A) $0

B) $861,883

C) $172,377

D) $800,000

Correct Answer:

Verified

Correct Answer:

Verified

Q9: Differences between income before taxes and taxable

Q39: Which of the following best describes the

Q45: A typical defined benefit pension plan formula

Q58: Derivative instruments acquired to hedge exposure to

Q58: Accountants use reserve accounts for various reasons,for

Q68: All of the following conditions signal that

Q80: Global,Inc.provides consulting services throughout the world.The company

Q83: The following information is related to the

Q87: Assume that Madison Corp.has agreed to construct

Q88: Cooke Industries imports and sells quality