Essay

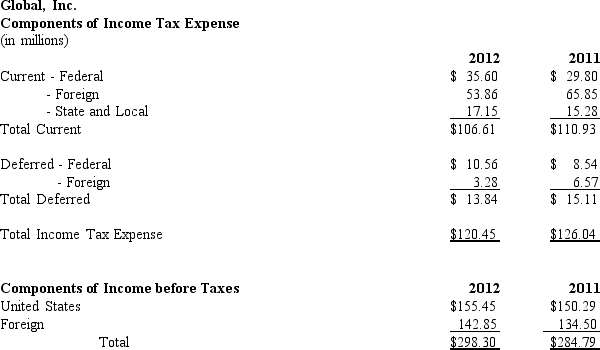

Global,Inc.provides consulting services throughout the world.The company pays taxes to the nation where revenues are earned.Information about the company's taxes are presented below:

Required:

a.Using the information provided for Global,prepare the company's journal entry to record income taxes for 2012 and 2011.

b.Using the information provided for Global,determine the company's effective tax rate for 2012 and 2011.

Correct Answer:

Verified

a.

b. The company's effective...View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Correct Answer:

Verified

b. The company's effective...

View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Q9: Differences between income before taxes and taxable

Q39: Which of the following best describes the

Q43: One sign that a company may be

Q49: Under current U.S.GAAP,unrealized gains and losses from

Q52: If the portions of the firm's foreign

Q58: Derivative instruments acquired to hedge exposure to

Q68: All of the following conditions signal that

Q78: Presented below is pension information related to

Q83: The following information is related to the

Q84: Parnell Industries<br>Parnell Industries sold a copy machine