Essay

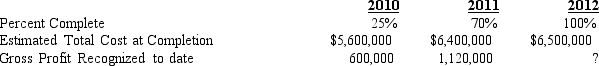

Bower Construction Comp.has consistently used the percentage-of-completion method for recognizing revenue on its long-term contracts.During 2010 Bower entered into a fixed-price contract to construct an office building for $8,000,000.Information relating to the contract is as follows:

Required (Show Calculations):

1.Compute contract costs incurred during 2010,2011 and 2012.

2.Determine how much gross profit Bower should recognize in 2012.

3.Under what conditions would it not be reasonable for a company to use the percentage of completion method of recognizing revenue on long-term contracts?

4.If Bower had used the completed contract method of accounting for this long-term contract how much gross profit would it have earned in 2010,2011 and 2012?

Correct Answer:

Verified

1.Contract casts = (// camplete a Estima...View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Correct Answer:

Verified

View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Q25: An inventory pricing procedure in which the

Q39: Which of the following best describes the

Q45: A typical defined benefit pension plan formula

Q58: Accountants use reserve accounts for various reasons,for

Q71: _ differences result from including revenues and

Q84: Parnell Industries<br>Parnell Industries sold a copy machine

Q87: Assume that Madison Corp.has agreed to construct

Q88: Cooke Industries imports and sells quality

Q91: Magnum Construction contracted to construct a

Q93: What are the foiur disclosures required by