Multiple Choice

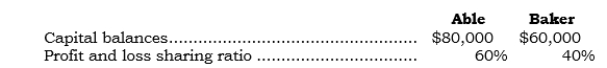

_____ Data for the partnership of Able and Baker follow: Cook is to be admitted into the partnership and is to have a one-fifth interest in capital and profits with a cash contribution of $40,000. The balances in the capital accounts of Able, Baker, and Cook under the recording the goodwill method are:

Cook is to be admitted into the partnership and is to have a one-fifth interest in capital and profits with a cash contribution of $40,000. The balances in the capital accounts of Able, Baker, and Cook under the recording the goodwill method are:

A) $80,000, $60,000, and $40,000, respectively.

B) $92,000, $68,000, and $40,000, respectively.

C) $95,000, $65,000, and $40,000, respectively.

D) $82,400, $61,600, and $36,000, respectively.

E) None of the above.

Correct Answer:

Verified

Correct Answer:

Verified

Q16: When a partner retires from a partnership,

Q17: When a partnership change in ownership occurs

Q18: When a partner retires from a partnership,

Q19: When two partnerships combine in a manner

Q20: When a partnership change in ownership occurs

Q22: _ Tax basis: Assume the following data

Q23: _ X and Y are partners and

Q24: When a partner withdraws from a partnership,

Q25: _ At 12/31/06, Reed and Quinn are

Q26: When a person is being admitted into