Multiple Choice

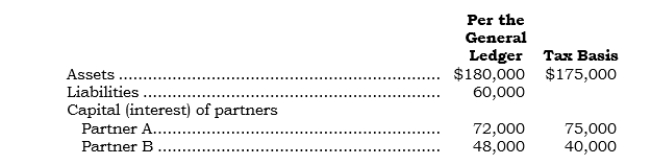

_____ Tax basis: Assume the following data for the partnership of A and B: A and B share profits and losses 75:25, respectively. C is admitted to a one-fifth interest in the capital and profits and losses of the partnership by contributing $40,000 (one-fifth of the net assets of the new firm) and assumes a one-fifth responsibility for present partnership obligations. The tax bases of A, B, and C after the admission of C are

A and B share profits and losses 75:25, respectively. C is admitted to a one-fifth interest in the capital and profits and losses of the partnership by contributing $40,000 (one-fifth of the net assets of the new firm) and assumes a one-fifth responsibility for present partnership obligations. The tax bases of A, B, and C after the admission of C are

A) $66,000, $37,000, and $52,000, respectively.

B) $69,000, $34,000, and $52,000, respectively.

C) $75,000, $40,000, and $40,000, respectively.

D) $75,000, $40,000, and $52,000, respectively.

E) $71,000, $36,000, and $48,000, respectively.

Correct Answer:

Verified

Correct Answer:

Verified

Q17: When a partnership change in ownership occurs

Q18: When a partner retires from a partnership,

Q19: When two partnerships combine in a manner

Q20: When a partnership change in ownership occurs

Q21: _ Data for the partnership of Able

Q23: _ X and Y are partners and

Q24: When a partner withdraws from a partnership,

Q25: _ At 12/31/06, Reed and Quinn are

Q26: When a person is being admitted into

Q27: _ Diller decided to withdraw from the