Short Answer

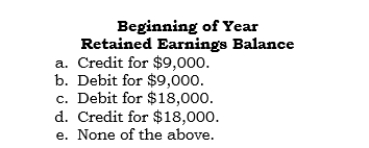

_____ On 1/1/06, Savtex, an Irish subsidiary of Pavtex, acquired a copyright for 100,000 LCU. Ireland's GAAP and income tax laws require amortization over no more than four years. Accordingly, Savtex uses a four-year life, even though the patent has a useful life of 10 years. Savtex's income tax rate is 40%. The worksheet adjusting entry required at 12/31/07 (not 2006) to restate to U.S. GAAP includes which of the following postings?

Correct Answer:

Verified

Correct Answer:

Verified

Q76: _ Under FAS 52, the term current

Q77: A basic procedure before translation is to

Q78: When the current rate method is used,

Q79: _ A parent owns a foreign subsidiary

Q80: A basic procedure before translation is to

Q82: When the current rate method is used,

Q83: _ Parco has a German subsidiary, Sarco.

Q84: _ Before a foreign subsidiary's financial position

Q85: When the current rate method is used,

Q86: _ A translation method that fits under