Multiple Choice

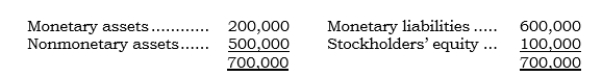

_____ Parco has a German subsidiary, Sarco. On 1/1/06, Parco concluded that the euro would weaken during the remainder of 2006. On this date, Sarco's balance sheet in euros was as follows: Sarco's functional currency is the euro. On 1/1/06, Parco entered into a 12-month FX forward to sell 100,000 euros at the forward rate of $.60 (the spot rate at the time was also $.60) . On 12/31/06, Parco settled the FX forward when the direct exchange rate was $.56. Using only the above information, what is Parco's change in its AOCI-Cumulative Translation Adjustment account for 2006?

Sarco's functional currency is the euro. On 1/1/06, Parco entered into a 12-month FX forward to sell 100,000 euros at the forward rate of $.60 (the spot rate at the time was also $.60) . On 12/31/06, Parco settled the FX forward when the direct exchange rate was $.56. Using only the above information, what is Parco's change in its AOCI-Cumulative Translation Adjustment account for 2006?

A) A $4,000 decrease from the translation process.

B) A $4,000 increase from the hedging transaction.

C) No change ($4,000 decrease from the translation process offset by $4,000 increase from the hedging transaction) .

D) An $8,000 decrease ($4,000 decrease from the translation process and $4,000 decrease from the hedging transaction) .

E) None of the above.

Correct Answer:

Verified

Correct Answer:

Verified

Q78: When the current rate method is used,

Q79: _ A parent owns a foreign subsidiary

Q80: A basic procedure before translation is to

Q81: _ On 1/1/06, Savtex, an Irish subsidiary

Q82: When the current rate method is used,

Q84: _ Before a foreign subsidiary's financial position

Q85: When the current rate method is used,

Q86: _ A translation method that fits under

Q87: _ Which exchange rates are used to

Q88: When the current rate method is used,