Multiple Choice

matching

based on the information given.

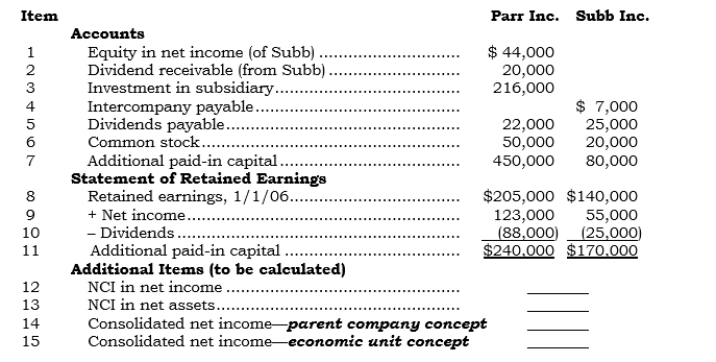

The following (a) seven account balances and (b) statements of retained earnings were obtained from the separate company statements of Parr Inc. and its 80%-owned created sub-sidiary, Subb Inc. (Parr's only subsidiary) , at the end of 2006:

When Subb was created (in 2004, 20% of the common shares it issued were sold to private investors.

When Subb was created (in 2004, 20% of the common shares it issued were sold to private investors.

Requirement 1:

How is each of the first 11 preceding items reported in Parr's 2006 consolidated statements? Use the following list of possible answer codes in the answer columns:

-_____(item 11)

A) Report at the amount shown in Subb's separate statements.

B) Report at the amount shown in Parr's separate statements.

C) Report at less than the sum of the amounts shown in Parr's and Subb's separate statements.

D) Report at the sum of the amounts shown in Parr's and Subb's separate statements.

E) Do not report this item in the consolidated statements or in the separate statements of either Parr or Subb.

F) Do not report this item in the consolidated statements.

G) Create this item in the consolidation process.

Correct Answer:

Verified

Correct Answer:

Verified

Q93: An 80% owned subsidiary is not consolidated

Q94: _ Paxel owns 80% of Saxel's outstanding

Q95: The company that must consolidate a variable

Q96: matching<br>based on the information given.<br>The following (a)

Q97: based on the information given.<br>The following (a)

Q99: _ Paxel owns 80% of Saxel's outstanding

Q100: _ Which of the following valuation techniques

Q101: matching<br>based on the information given.<br>The following (a)

Q102: _ Which of the following methods reports

Q103: All VIEs must be consolidated.