Short Answer

based on the information given.

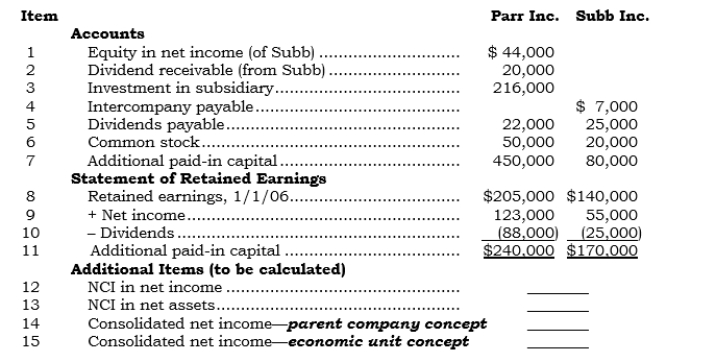

The following (a) seven account balances and (b) statements of retained earnings were obtained from the separate company statements of Parr Inc. and its 80%-owned created sub-sidiary, Subb Inc. (Parr's only subsidiary), at the end of 2006:

When Subb was created (in 2004, 20% of the common shares it issued were sold to private investors.

When Subb was created (in 2004, 20% of the common shares it issued were sold to private investors.

Requirement 2:

For items 12-15, calculate the amount that would appear in the 2006 consolidated statements

-_____(item 12)

Correct Answer:

Verified

Correct Answer:

Verified

Q92: The intent of the U.S. Internal Revenue

Q93: An 80% owned subsidiary is not consolidated

Q94: _ Paxel owns 80% of Saxel's outstanding

Q95: The company that must consolidate a variable

Q96: matching<br>based on the information given.<br>The following (a)

Q98: matching<br>based on the information given.<br>The following (a)

Q99: _ Paxel owns 80% of Saxel's outstanding

Q100: _ Which of the following valuation techniques

Q101: matching<br>based on the information given.<br>The following (a)

Q102: _ Which of the following methods reports