Multiple Choice

Figure 12.1

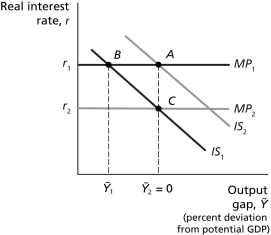

-Refer to Figure 12.1...Suppose the economy is initially at full employment with real GDP equal to potential GDP,and the expected inflation rate equal to the actual inflation rate.If the economy then experiences a negative demand shock,and the central bank responds to the results of the demand shock with an appropriate monetary policy,the central bank response will

A) push the economy further down the Phillips curve, lowering the inflation rate further.

B) push the economy back up the Phillips curve, raising the inflation rate toward its full-employment level.

C) push the economy back down the Phillips curve, lowering the inflation rate towards its full-employment level.

D) push the economy further up the Phillips curve, lowering the inflation rate further.

Correct Answer:

Verified

Correct Answer:

Verified

Q73: The Board of Directors of the Bank

Q74: Assume that the term structure effect and

Q75: Under a fixed exchange rate system,if the

Q76: In general,if the Bank of Canada increases

Q77: What are the main arguments for and

Q79: Figure 12.4<br> <img src="https://d2lvgg3v3hfg70.cloudfront.net/TB4177/.jpg" alt="Figure 12.4

Q80: What are the effects of an expansionary

Q81: Some economists and policymakers criticized the Fed

Q82: Figure 12.3<br> <img src="https://d2lvgg3v3hfg70.cloudfront.net/TB4177/.jpg" alt="Figure 12.3

Q83: Through open market operations,the Bank of Canada<br>A)