Multiple Choice

Figure 12.4

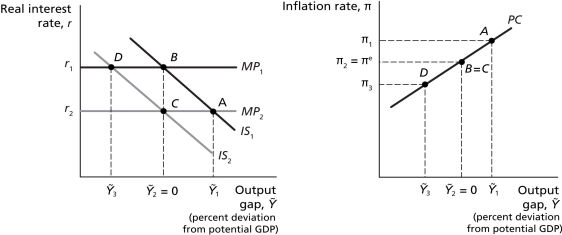

Scenario: The above figures represent the economy of Mondolvia, where points A, B, C, and D in the first figure reflect the corresponding points in the second figure. The economy of Mondolvia is initially at equilibrium with real GDP equal to potential GDP. In April 2012, Mondolvia reached the peak of a rapid housing bubble that dramatically increased consumer wealth. The central bank of Mondolvia recognized this housing bubble peak existed in June, 2012 and implemented corrective policy in August 2012. The corrective policy actually changed output in the economy 12 months after it was implemented. In the meantime, the housing bubble burst in December 2012, returning the economy back to its initial, pre-bubble equilibrium level.

-Refer to Figure 12.4.As a result of the monetary policy taking effect after the housing bubble had already burst,real GDP will be ________ potential GDP and the rate of inflation will be ________ the rate of inflation when the economy was initially in equilibrium.

A) greater than; greater than

B) greater than; less than

C) less than; less than

D) less than; equal to

Correct Answer:

Verified

Correct Answer:

Verified

Q12: If exchange rates are floating,the Bank of

Q14: Suppose oil prices suddenly begin to rise

Q15: With a contractionary monetary policy,as the output

Q16: Quantitative easing is a central bank policy

Q18: Assume that the Bank of Canada knows

Q19: Assume it takes the Bank of Canada

Q20: Figure 12.4<br> <img src="https://d2lvgg3v3hfg70.cloudfront.net/TB4177/.jpg" alt="Figure 12.4

Q21: Figure 12.3<br> <img src="https://d2lvgg3v3hfg70.cloudfront.net/TB4177/.jpg" alt="Figure 12.3

Q22: A study conducted by Alberto Alesina and

Q27: What is the policy trilemma?