Multiple Choice

Figure 14.3

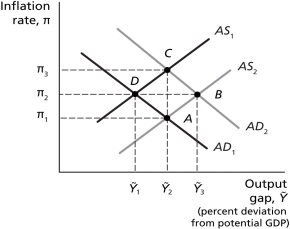

-Refer to Figure 14.3.Suppose the economy is initially at long-run equilibrium and the economy experiences a demand shock such as a stock market crash.The economy then reaches a new,short-run equilibrium point.Assuming expectations are adaptive,this will allow the central bank to decrease the real interest rate,moving the economy to a another new equilibrium point.The stock market crash is temporary,so as the economy works its way back to long-run equilibrium,real GDP will increase.As the expected rate of inflation changes,the economy will move from

A) point A to point C.

B) point D to point C.

C) point A to point D.

D) point B to point C.

Correct Answer:

Verified

Correct Answer:

Verified

Q35: There is no trade-off between inflation and

Q36: When the economy responds to a supply

Q37: Figure 14.3<br> <img src="https://d2lvgg3v3hfg70.cloudfront.net/TB4177/.jpg" alt="Figure 14.3

Q38: Suppose the economy is initially in equilibrium

Q39: Figure 14.3<br> <img src="https://d2lvgg3v3hfg70.cloudfront.net/TB4177/.jpg" alt="Figure 14.3

Q41: Use a graph to show the differences

Q42: The economy is in long-run equilibrium when

Q43: Figure 14.1<br> <img src="https://d2lvgg3v3hfg70.cloudfront.net/TB4177/.jpg" alt="Figure 14.1

Q44: Assume that the Bank of Canada has

Q45: Suppose the economy is initially in equilibrium