Multiple Choice

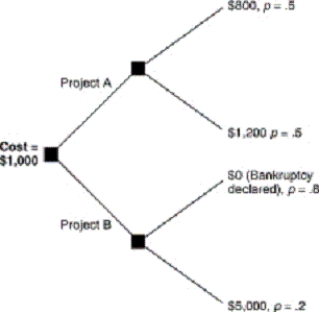

Consider this decision tree,which represents the outcomes of two alternative projects that Ink Inc.,a producer of printers,might pursue.Ink Inc.,needs to borrow $1,000 to pursue either project and is going to sell bonds to finance the venture.

Ink,Inc.,is carrying a large amount of debt because of overexpansion during the dot-com explosion.Under these circumstances,the shareholders would tend to choose:

A) project A, because it has the highest expected value.

B) project B, because it has the greatest degree of risk.

C) project A, because it has the lowest degree of risk.

D) neither project A nor B, because both are risky.

E) either project A or B; both have the same degree of risk.

Correct Answer:

Verified

Correct Answer:

Verified

Q1: A technique for dealing with the principal-agent

Q3: A manager has a utility function U

Q4: Principal-agent problems can exist between:<br>A) workers and

Q5: Consider this decision tree,which represents the outcomes

Q6: A manager has a utility function U

Q7: Incentive-compatible employment contracts exist when:<br>A) the firm

Q8: Optimal employment contracts for managers,given revenue risk

Q9: Firms can avoid or limit the asset

Q10: Creditors and shareholders may have an incentive

Q11: Suppose that Wilma's utility function is given