Multiple Choice

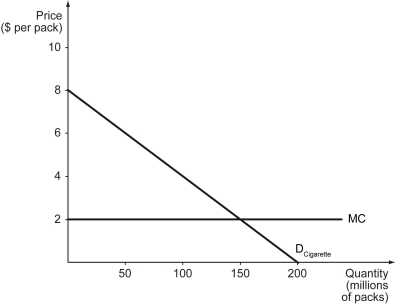

Scenario: Tobac Co. is a monopolist in the cigarette market in Nicotiana Republic, where the U.S. dollar is used as the official currency. The firm faces the demand curve shown below. The firm has a constant marginal cost of $2.00 per pack. The fixed cost of the firm is $50 million. To answer the questions below, it is useful to know that the equation of the (inverse) demand curve is P = 8 - 0.04Q, where Q is the quantity demanded (in millions of packs) and P is the price per pack (in $) . Also, you should draw in the marginal revenue curve.

-Refer to the scenario above.If the quantity sold is 150 million packs,the firm's profit is ________.

A) $100 million

B) $50 million

C) $0

D) -$50 million

Correct Answer:

Verified

Correct Answer:

Verified

Q268: When firms charge different prices to different

Q269: Suppose that a fire-fighting service is offered

Q270: Firms with market power _.<br>A) are price

Q271: The following figure shows the costs and

Q272: Which of the following firms is most

Q274: How does a monopoly decide the optimal

Q275: What are the problems associated with price

Q276: A monopolist faces an average total cost

Q277: A monopolist faces a linear,downward-sloping demand curve.If

Q278: In the United States,the _ is a