Multiple Choice

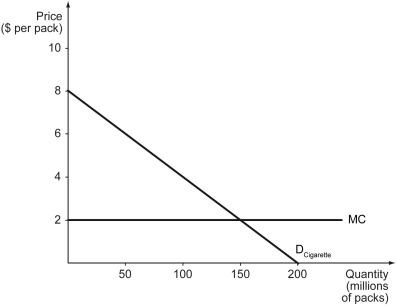

Scenario: Tobac Co. is a monopolist in cigarette market in Nicotiana Republic where the U.S. dollar is used as its official currency. The firm faces the demand curve shown below. The firm has a constant marginal cost of $2.00 per pack. The fixed cost of the firm is $50 million. To answer the questions below, it is useful to know that the equation of the (inverse) demand curve is P = 8 - 0.04Q, where Q is the quantity demanded (in millions of packs) and P is the price per pack (in $) . Also, you should draw in the marginal revenue curve.

-Refer to the scenario above.When Tobac Co.'s profit is maximized,each pack of cigarette is sold for ________.

A) $5.00

B) $4.00

C) $3.00

D) $2.00

Correct Answer:

Verified

Correct Answer:

Verified

Q96: Which of the following statements is true?<br>A)

Q97: Perfect price discrimination is also referred to

Q98: The outcome of first-degree price discrimination is

Q99: If a firm can sell 10 units

Q100: The following table shows the quantities of

Q102: Sellers in _ are likely to have

Q103: The following figure shows the costs and

Q104: Which of the following is NOT an

Q105: The following figure shows the demand (D),

Q106: The following figure shows the demand curve,