Multiple Choice

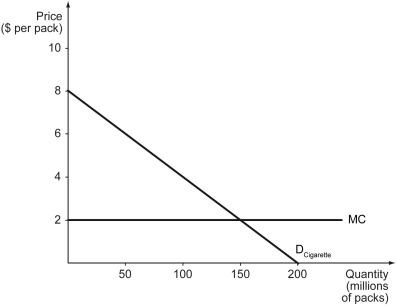

Scenario: Tobac Co. is a monopolist in cigarette market in Nicotiana Republic where the U.S. dollar is used as its official currency. The firm faces the demand curve shown below. The firm has a constant marginal cost of $2.00 per pack. The fixed cost of the firm is $50 million. To answer the questions below, it is useful to know that the equation of the (inverse) demand curve is P = 8 - 0.04Q, where Q is the quantity demanded (in millions of packs) and P is the price per pack (in $) . Also, you should draw in the marginal revenue curve.

-Refer to the scenario above.When Tobac Co.'s profit is maximized,the deadweight loss is ________.

A) $140.5 million

B) $125 million

C) $112.5 million

D) $100 million

Correct Answer:

Verified

Correct Answer:

Verified

Q37: Which of the following statements is true?<br>A)

Q38: The following table shows the quantities of

Q39: A firm with market power _.<br>A) faces

Q40: The following table shows the quantities of

Q41: Scenario: Mr. Olivander has a monopoly on

Q43: Under fair-returns price regulation,_.<br>A) deadweight loss is

Q44: The following figure represents the cost and

Q45: An efficient price is a price set

Q46: The following figure shows the demand curve,

Q47: What makes World's Fair of 1876,in Philadelphia