Multiple Choice

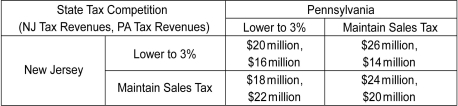

Scenario: Contiguous states often use tax policy to attract residents, firms, and economic activity. These "tax competitions" between states can be modeled with game theory. Suppose New Jersey currently has a state sales tax of 7 percent and Pennsylvania has a state sales tax of 6 percent. The game shown below models the effect of a reduction in each state's sales tax rate to 3 percent on each state's sales tax revenue. Assume the motivation of each state is to maximize tax revenue. The first number in a cell is the payoff to New Jersey; the second number is the payoff to Pennsylvania.

(Source: John Greenwald, "A No-Win War Between the States," Time, April 8, 1996, 44-45.

-Refer to the scenario above.Does Pennsylvania have a dominant strategy?

A) No.

B) Yes. Regardless of whether New Jersey decides to lower its sales tax rate, Pennsylvania will always gain more revenue by lowering their sales tax rate to 3 percent.

C) Yes. Regardless of whether New Jersey decides to lower its sales tax rate, Pennsylvania will always gain more revenue by maintaining their sales tax rate at 6 percent.

D) Not enough information is provided to answer the question.

Correct Answer:

Verified

Correct Answer:

Verified

Q33: Scenario: Contiguous states often use tax policy

Q34: Which of the following games is a

Q35: Scenario: Rita and Mike have been caught

Q36: Scenario: Two firms in a market sell

Q37: Suppose you and your roommate are trying

Q39: Scenario: Miguel and Stephanie are competitors who

Q40: Scenario: Jack and Jill have gone cycling

Q41: Scenario: Suppose two soda brands, Mountain Dew

Q42: Sam Walton chose a very different strategy

Q43: How do we arrive at a Nash