Multiple Choice

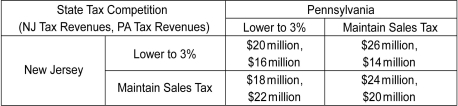

Scenario: Contiguous states often use tax policy to attract residents, firms, and economic activity. These "tax competitions" between states can be modeled with game theory. Suppose New Jersey currently has a state sales tax of 7 percent and Pennsylvania has a state sales tax of 6 percent. The game shown below models the effect of a reduction in each state's sales tax rate to 3 percent on each state's sales tax revenue. Assume the motivation of each state is to maximize tax revenue. The first number in a cell is the payoff to New Jersey; the second number is the payoff to Pennsylvania.

(Source: John Greenwald, "A No-Win War Between the States," Time, April 8, 1996, 44-45.

-Refer to the scenario above.Is there a dominant strategy equilibrium?

A) No.

B) Yes, New Jersey lowers its sales tax rate to 3 percent and Pennsylvania maintains its sales tax rate.

C) Yes, both New Jersey and Pennsylvania maintain their sales tax rates.

D) Yes, both New Jersey and Pennsylvania lower their sales tax rates to 3 percent.

Correct Answer:

Verified

Correct Answer:

Verified

Q28: Recall the trust game reported in the

Q29: In a game,a Nash equilibrium is reached

Q30: Refer to Evidence-Based Economics element in section

Q31: Scenario: Diana and Artemis can either jointly

Q32: Scenario: Diana and Artemis can either jointly

Q34: Which of the following games is a

Q35: Scenario: Rita and Mike have been caught

Q36: Scenario: Two firms in a market sell

Q37: Suppose you and your roommate are trying

Q38: Scenario: Contiguous states often use tax policy