Multiple Choice

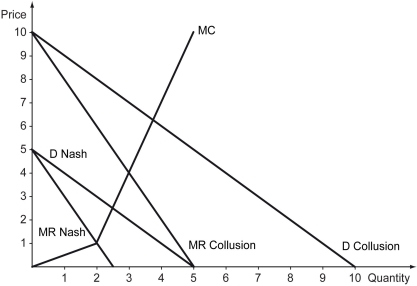

Scenario: There are two firms in an industry, Firm A and Firm B, and they consider entering into a colluding agreement. If the two firms collude, then they agree that they would both produce less than what they would if they were competing against each other in an oligopolistic market. Since Firm A expects Firm B to produce a small quantity of output in the colloding agreement, Firm A is facing a demand curve with the same slope but with a higher intercept. The following figure depicts demands that face Firm A in both the colluding agreement and the oligopolistic market.

-Refer to the scenario above.What is the profit of Firm A without collusion?

A) $4

B) $6

C) $9

D) $21

Correct Answer:

Verified

Correct Answer:

Verified

Q37: Scenario: Two firms, Firm 1 and Firm

Q38: The following figure shows the revenue and

Q39: The equilibrium price charged by a monopolistic

Q40: A monopolistically competitive firm _.<br>A) can increase

Q41: All firms in a monopolistically competitive industry

Q43: A monopolistically competitive firm shuts down in

Q44: An oligopoly market with identical products is

Q45: Scenario: The fixed cost of producing 500

Q46: How is a duopoly model with homogeneous

Q47: Markets in which the Herfindahl-Hirschman Index _