Essay

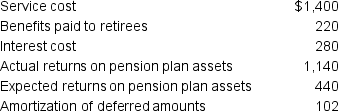

Sweets Corp. reported the following items in the 2016 pension footnote. Use the information to calculate the pension expense for the year.

Correct Answer:

Verified

Pension expense = Service cost...View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Correct Answer:

Verified

View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Q24: GAAP identifies two different approaches in reporting

Q25: Complete Foods Markets reports lease information in

Q26: Which of the following is a requirement

Q27: Pacific Northwest Sporting Goods reported annual depreciation

Q28: American Symbol Outfitters includes the following information

Q30: Operating leases increase interest expense in the

Q31: Andersen Laboratories' 2016 annual report includes the

Q32: The increase in pension obligation due to

Q33: Leases are often a better financing vehicle

Q34: La Grange Supply Company disclosed the following