Essay

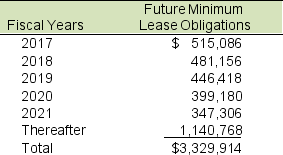

American Symbol Outfitters includes the following information about its operating leases in its fiscal 2016 annual report:

A. Calculate the present value of operating lease payments using a discount rate of 6%.

A. Calculate the present value of operating lease payments using a discount rate of 6%.

B. Assume that the leased equipment has a useful life of 8 years and no salvage value. Estimate the effect on profit before taxes of capitalizing these leases. Assume straight-line depreciation. Assume that rental expense in 2016 is the same as 2017 lease payments.

C. How would ROE and other financial ratios from the ROE decomposition be affected if these the company capitalized these operating leases?

Correct Answer:

Verified

A. Using the NPV function in Excel, the ...View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Correct Answer:

Verified

View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Q23: Failure to capitalize leased assets and liabilities

Q24: GAAP identifies two different approaches in reporting

Q25: Complete Foods Markets reports lease information in

Q26: Which of the following is a requirement

Q27: Pacific Northwest Sporting Goods reported annual depreciation

Q29: Sweets Corp. reported the following items in

Q30: Operating leases increase interest expense in the

Q31: Andersen Laboratories' 2016 annual report includes the

Q32: The increase in pension obligation due to

Q33: Leases are often a better financing vehicle