Multiple Choice

Use the following information for questions below:

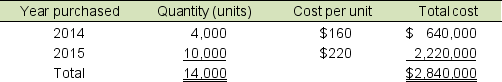

Wonderland Company imports and sells a product produced in Canada. In the summer of 2016, a natural disaster disrupted production, affecting its supply of product. On January 1, 2016, Wonderland's inventory records were as follows:

Through mid-December of 2016, purchases were limited to16,000 units, because the cost had increased to $320 per unit. Wonderland sold 18,400 units during 2016 at a price of $392 per unit, which significantly depleted its inventory.

Through mid-December of 2016, purchases were limited to16,000 units, because the cost had increased to $320 per unit. Wonderland sold 18,400 units during 2016 at a price of $392 per unit, which significantly depleted its inventory.

-Assume that Wonderland purchases 22,800 more of the $320 units on December 31, 2016. Wonderland uses the FIFO inventory method.

Compute Wonderland's gross profit for 2016.

A) $2,964,800

B) $2,044,800

C) $2,073,200

D) $1,714,400

Correct Answer:

Verified

Correct Answer:

Verified

Q43: The following data refer to Sean Company's

Q44: Mountain Gas Company, a large national company

Q45: The following are excerpted from Super Drug

Q46: The cost of acquiring inventory includes adding

Q47: Gross profit is calculated as net sales

Q49: FIFO inventory costing yields more accurate reporting

Q50: Assuming rising prices, which method will give

Q51: A decline in gross profit margin can

Q52: In periods of rising prices, companies that

Q53: The following hammers were available for sale