Essay

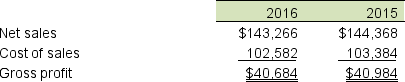

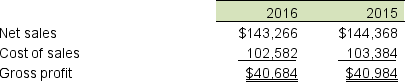

The following are excerpted from Super Drug Store's 2016 financial statements (in millions):

Super Drug Store's inventory footnote follows:

Super Drug Store's inventory footnote follows:

Inventories

Inventories are valued on a lower of last-in, first-out (LIFO) cost or market basis. At August 31, 2016 and 2015, inventories would have been greater by $3,794 million and $3,174 million, respectively, if they had been valued on a lower of first-in, first-out (FIFO) cost or market basis. Inventory includes product cost, inbound freight, warehousing costs and vendor allowances that are not included as a reduction of advertising expense.

A. How much is Super Drug Store's ratio of inventories to current assets for each year? Does this percentage make sense in Super Drug Store's industry? What does the change suggest about Super Drug Store?

B. Calculate the ratio of inventories to current assets under the FIFO method for both years. Why does it differ from your answer to part A?

C. Compute the inventory turnover ratios for 2016 and 2015 (ending inventory in 2014 is $18,445). What does this say about the company?

D. Is it correct to include in-bound freight in Super Drug Store's inventory cost? Why or why not?

Correct Answer:

Verified

A. 2016: $17,590 / $25,038 = 70.25%

2015...View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Correct Answer:

Verified

2015...

View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Q40: A summary of inventory records for Goldwater

Q41: As a shareholder of Wesleyan Industries, a

Q42: Use the following information for questions below:

Q43: The following data refer to Sean Company's

Q44: Mountain Gas Company, a large national company

Q46: The cost of acquiring inventory includes adding

Q47: Gross profit is calculated as net sales

Q48: Use the following information for questions below:

Q49: FIFO inventory costing yields more accurate reporting

Q50: Assuming rising prices, which method will give