Essay

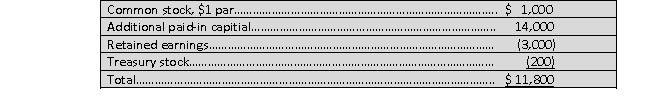

On January 1, 2020, Panadrone Inc. acquired all of the stock of Skyline Telecom for $85,000 in cash. At the date of acquisition, Skyline's shareholders' equity accounts were as follows:

Both companies have a December 31 year-end. At the date of acquisition, Skyline reported net assets had book values approximating fair value. However, it had previously unreported indefinite life identifiable intangibles valued at $15,000, meeting ASC Topic 805 requirements for capitalization. Impairment losses in 2020 for identifiable intangibles were $600. Goodwill from this acquisition was not impaired in 2020. Skyline reported net income of $900 in 2020, and paid no dividends. Panadrome uses the complete equity method to report its investment in Skyline on its own books.

Both companies have a December 31 year-end. At the date of acquisition, Skyline reported net assets had book values approximating fair value. However, it had previously unreported indefinite life identifiable intangibles valued at $15,000, meeting ASC Topic 805 requirements for capitalization. Impairment losses in 2020 for identifiable intangibles were $600. Goodwill from this acquisition was not impaired in 2020. Skyline reported net income of $900 in 2020, and paid no dividends. Panadrome uses the complete equity method to report its investment in Skyline on its own books.

Required

a. Calculate the original amount of goodwill for this acquisition.

b. Calculate equity in net income of Skyline, reported on Panadrone's books in 2020.

c. Prepare eliminating entries (C), (E), (R) and (O), required to consolidate Panadrone's trial balance accounts with those of Skyline on December 31, 2020.

Correct Answer:

Verified

Correct Answer:

Verified

Q57: How does the complete equity method, used

Q58: Which statement is false concerning IFRS for

Q59: The major justification for adding a qualitative

Q60: A wholly-owned subsidiary reports income of $5

Q61: A company follows IFRS and chooses to

Q63: Pacific Corporation acquired all of the voting

Q64: Which of the following previously unreported intangible

Q65: Use the following information to answer bellow

Q66: Use the following information to answer bellow

Q67: A merger on January 1, 2021