Essay

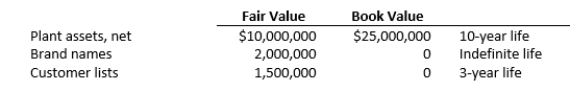

Pacific Corporation acquired all of the voting stock of Seagate Inc. at an acquisition cost of $500 million on January 1, 2020. Seagate's book value at the date of acquisition was $90 million, consisting of $10 million in capital stock, $85 million in retained earnings, and $5 million in treasury stock. Seagate's identifiable net assets were revalued as follows:

During 2020, Seagate reported net income of $6,000,000 and declared and paid dividends of $1,000,000. Seagate does not report any other comprehensive income. The brand names were impaired by $200,000. Pacific reports its investment in Seagate on its own books using the complete equity method.

During 2020, Seagate reported net income of $6,000,000 and declared and paid dividends of $1,000,000. Seagate does not report any other comprehensive income. The brand names were impaired by $200,000. Pacific reports its investment in Seagate on its own books using the complete equity method.

Required

a. Calculate equity in net income for 2020, reported on Pacific's books.

b. Prepare eliminating entries (C), (E), (R) and (O), to consolidate the trial balances of Pacific and Seagate at December 31, 2020. Assume all revaluation write-offs are reported as adjustments to operating expenses.

Correct Answer:

Verified

Correct Answer:

Verified

Q58: Which statement is false concerning IFRS for

Q59: The major justification for adding a qualitative

Q60: A wholly-owned subsidiary reports income of $5

Q61: A company follows IFRS and chooses to

Q62: On January 1, 2020, Panadrone Inc. acquired

Q64: Which of the following previously unreported intangible

Q65: Use the following information to answer bellow

Q66: Use the following information to answer bellow

Q67: A merger on January 1, 2021

Q68: Primera Company acquired Stargaze Corporation on