Essay

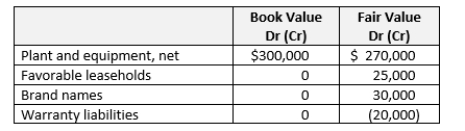

On January 1, 2019, Penn Corporation acquired the voting stock of Shea Company at an acquisition cost of $450,000. Some of Shea's assets and liabilities at the date of acquisition had fair values that were different from reported values, as follows:

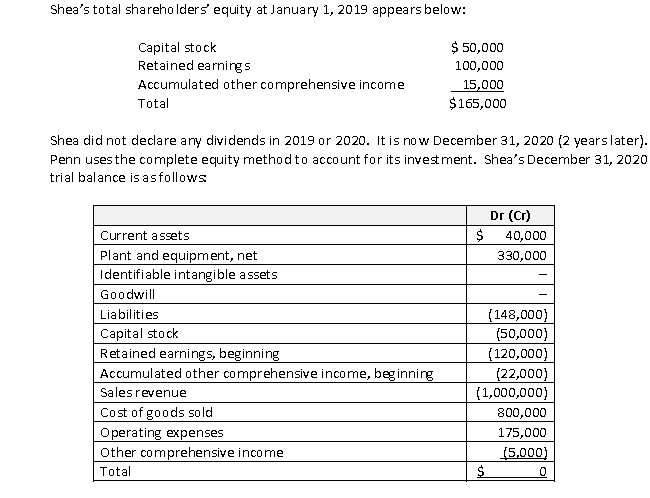

At the date of acquisition, the plant and equipment had a 10-year remaining life, and the favorable leases had a 5-year remaining life, straight-line. The brand names are indefinite life assets. They were impaired by $3,000 in 2019, and were not impaired in 2020. Goodwill from this acquisition is not impaired as of the beginning of 2020, but goodwill impairment for 2020 is $1,000. Warranty payments connected with the revaluation liability were $500 in 2019 and $1,500 in 2020.

At the date of acquisition, the plant and equipment had a 10-year remaining life, and the favorable leases had a 5-year remaining life, straight-line. The brand names are indefinite life assets. They were impaired by $3,000 in 2019, and were not impaired in 2020. Goodwill from this acquisition is not impaired as of the beginning of 2020, but goodwill impairment for 2020 is $1,000. Warranty payments connected with the revaluation liability were $500 in 2019 and $1,500 in 2020.

Shea does not pay dividends.

Shea does not pay dividends.

Required

a. Calculate the goodwill recognized with this acquisition.

b. Calculate equity in net income for 2019 and 2020, reported on Penn's books.

c. Calculate the December 31, 2020 balance for Investment in Shea, reported on Penn's books.

d. Present consolidation eliminating entries (C), (E), (R) and (O) to consolidate the December 31, 2020 trial balances of Penn and Shea.

Correct Answer:

Verified

Correct Answer:

Verified

Q105: Use the following information to answer

Q106: A wholly-owned subsidiary's revalued net assets at

Q107: A subsidiary still holds all net assets

Q108: Which of the following is not a

Q109: Use the following information to answer bellow

Q110: A company uses IFRS and chooses to

Q111: A company reports $11.2 million in

Q112: The interest rate at which an acquired

Q113: Which statement is true regarding the U.S.

Q114: At the date of acquisition, a subsidiary's